AGRICULTURE, FORESTRY AND FISHERIES

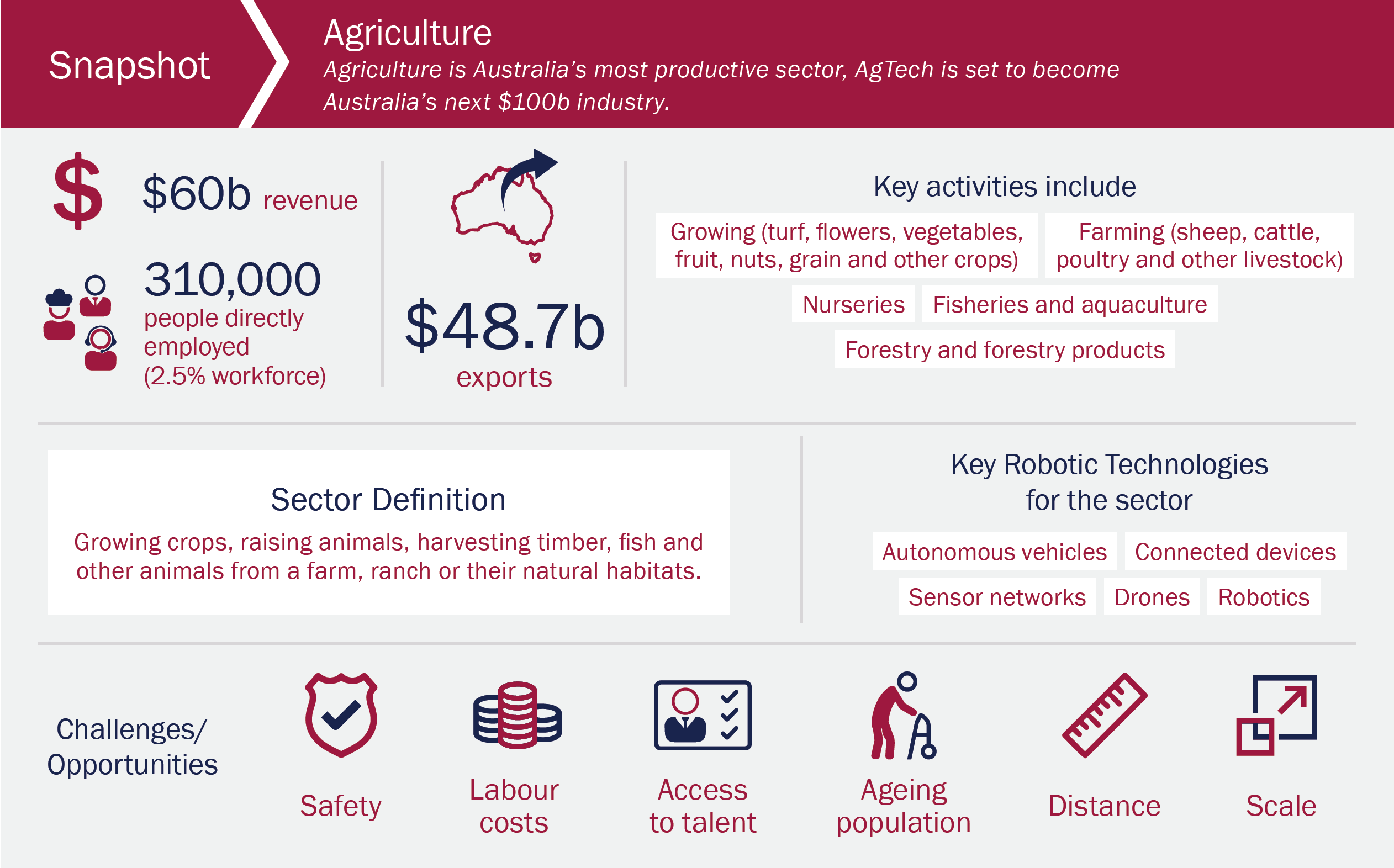

The Australian agriculture, forestry and fisheries industry was estimated to have grossed more than $AU60 billion in 2016-17, with exports reaching a record $AU52.6 billion [ABA17-1, 17-2, 17-3]

Australian agriculture, forestry and fisheries

Most exports were from agriculture, with 5.9 per cent from forestry, and 2.9 per cent attributed to fisheries. Demand is expected to increase rapidly due to the surge in the middle-class population in Asia and the rise of the bioeconomy (e.g, biofuels and plastics). The demand from Asia may result in a doubling of agricultural exports by 2050, while the bioeconomy is expected to be worth $US90 billion worldwide by 2020. On a broader scale, the United Nations Food and Agriculture Organisation have estimated that the world must increase agricultural output by 70 per cent to guarantee food security by 2050 [FAO17].

Agriculture, forestry and fisheries face many challenges in Australia. While Australia exports more than 50 per cent of the food it produces, there is tremendous waste along the food value chain, with estimates that as much of half of all production is wasted before it reaches the consumer. In Australia, approximately 50 per cent of the land mass is devoted to agriculture but $AU2.5 billion is lost due to weeds, and a further $AU1.5 billion is spent trying to control these. The ancient fragile nature of Australian soils means many areas are infertile, requiring high use of chemical fertilisers and making them highly susceptible to erosion and nutrient runoff. Approximately 46 per cent of Australian famers report issues with soil and land while 38 per cent of farmers experience issues relating to water (e.g., access, salinity, floods, and droughts) [KPMG16, NFF17].

Remote and regional areas of Australia, where agriculture and forestry activities are concentrated, cover 85 per cent of the Australian land mass and produce 40 per cent of gross domestic product (GDP) (see Chapter 4). However, the vast distances present numerous challenges in service delivery, freight distribution, and telecommunications. Like most developed countries, over the course of the 20th century, the proportion of the Australian population residing in rural areas and/or working in agriculture has declined dramatically. Now, less than 10 per cent of Australians live in regional or rural areas. At the same time, the population is ageing due to sustained low fertility and increased life expectancy. This has resulted in proportionally fewer children (under 15 years of age) in the population and a proportionally larger increase in those aged 65 and over. Approximately 37 per cent of workers in the agriculture, forestry and fisheries industry are aged 55 or over, the most of any industry in Australia. The median age for workers in this industry is 48 years, while the average farmer is 52 years old. Over the past 30 years, the median age of farmers has increased nine years, while the number of farming households has almost halved, from 168,000 to 85,700, over the same time [ABA17-1]. The combination of an ageing workforce, the remoteness of most agriculture, forestry and fishing operations, and the vast distances they may cover, makes innovation and the development of new technologies a pressing need, which is where robotics can play an important role.

Agricultural technologies (AgTech) is defined as the collection of digital technologies that provide the industry with the tools, data and knowledge to make more informed real-time decisions to improve productivity and sustainability [KPMG16]. Typically, AgTech concerns autonomous vehicles, computer hardware and software, cloud computing, cloud robotics, UAVs, the internet of things (IoT), precision agriculture, and big data and analytics. The global opportunity in AgTech is estimated to be worth almost $AU250 billion, with growing interest and focus from industry, government, investors, corporates and farmers driving significant innovation, focus and funding. The market for UAV solutions alone in agriculture is valued at $AU42.2 billion [IB16]. Real momentum has been generated in the sector and it is predicted that AgTech is set to become Australia’s next $AU100 billion industry by 2030 [KPMG16].