The future of robotics in distribution services

Transport

The application of robotic technologies in distribution services has the potential to hugely influence all sectors of the Australian economy. Examples include enabling reduced infrastructure costs, benefit to all other industries, reduced costs of transporting goods (both within Australia and to export), provision of goods (and services) to remote communities, improved safety, less accidents, fewer cars/trucks as more efficient, but also, widespread job loss.

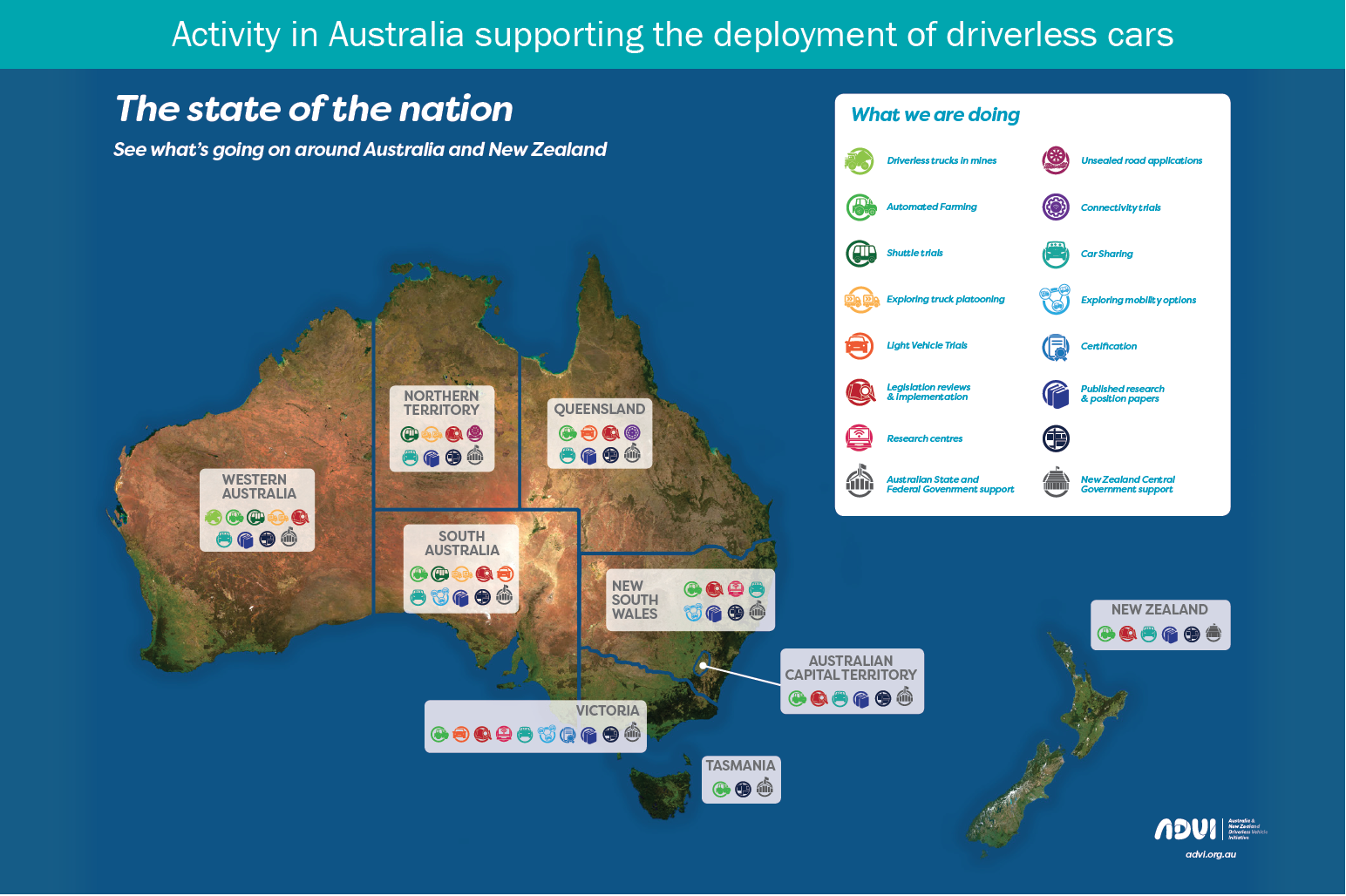

Given the lack of an automotive manufacturing industry, Australia’s primary role in preparing for connected and autonomous vehicles lies in supporting infrastructure, regulations and technological advancements. In Queensland alone, the Department of Transport and Main Roads estimates that 20 per cent of the state’s fleet will be autonomous between 2034 and 2045, increasing to 100 per cent between 2048 and 2057, with similar benefits expected for all Australian states. Globally, the development of a new passenger economy is predicted to be worth more than $US7 trillion by 2050 [SA17]. This figure is based on the development of new services, such as provision of self-driving car services (transportation, delivery) to consumers and businesses, as well as the development of new applications and services, and the social benefits of creating a time surplus.

Increased road safety

Each year, road accidents kill approximately 1,400 Australians, and hospitalise another 32,500 [NRS11]. The annual economic cost of road accidents in Australia is estimated at $AU27 billion per annum [ABC17]. Between 2003-2015, there were 583 work-related fatalities in the road transport industry, with 92 per cent (535) occurring in the road freight transport industry [SWA18]. The World Health Organisation estimates that governments spend 3% of GDP on costs related to traffic accidents (approximately $US2.3 trillion) [WHO15].

Platooning and higher speeds to reduce congestion

The economic cost of avoidable congestion in Australia was estimated at $AU16.5 billion for the 2015 financial year [ASoE16]. The introduction of self-driving vehicles will allow transportation at higher speeds, and the use of strategies, such as platooning, to lower fuel costs and reduce congestion on the country’s roads.

Increased driver freedom

Most commuters spend more than 30 minutes in a car every work day, equating to at least 60 billion hours driving per year, which could be applied to other activities [SA17].

Increased Productivity

Self-driving vehicles will be able to make deliveries 24 hours a day, seven days a week, resulting in improved productivity for transportation companies. The role of a driver will be redefined, and might include inventory and supply chain management, and customer service.

Logistics

Australia was an early adopter of automation in the storage, picking, and packing of goods, with many warehouses containing some level of automated equipment since the early 1990s. While this was not robotic equipment, it sets the scene for robotics to become more common as these automated sites reach the end of their existence. Robots, and automation, in logistics is becoming ubiquitous in Australia, particularly with Amazon (one of the largest robot companies in the world) moving into the Australian market. An example of this is the number of Autostore systems in use in distribution centres. Autostores are mobile robots, on a framework, that operate above stacks of crates and totes.

Retail

The Australian retail market is relatively small, with large distances between consumers, and low growth in population. This requires economies of scale for national retailers to deliver items to consumers across that market in a consistent manner. As retail accounts for some of the lowest paid unskilled jobs in the services sector, it is likely to be strongly disrupted by automation. Robots will soon be used for shelf scanning, to eliminate stock runouts and items in wrong location, shelf-filling and dynamic shelving, and moving of unit load devices (pallets, trolleys, roll-cages) from transport to display.

Customer-facing robots in retail are extremely rare in Australia, however, in countries such as Japan they are becoming commonplace and it is likely that Australia will follow this trend. With digital sales set to double over the next 10 years, reaching an average of 20 to 25 per cent, stores can no longer restrict themselves to a solely transactional role, and need to refocus on in-store experience [ROL16]. Worldwide growth in retail, or ‘public relation’ robots, was expected to increase by 37 per cent in 2017, with sales of Softbank’s social robot ‘Pepper’ believed to have exceeded 20,000 units [IFRSR17]. These robots are increasingly used in public environments to offer services, attract customer attention, and promote sales. Working with IBM to jointly develop their Watson artificial intelligence technology for the Japanese market, Softbank has applied AI to the Pepper robot, processing customer dialogues, and operating in more than 1,000 independent retail outlets [IFRSR17]. Preliminary studies suggest that a combination of retail robots can produce a 10 to 30 percent increase in periodic store traffic, as well as reduced staff costs, and the creation of a positive, and efficient shopping experience [ROL16].

Robots in retail must create new customer experiences, optimise customer pathways by providing real-time data and analytics, increase the fluidity of in-store procedures, and perform a high number of low value tasks [RR16]. Opportunities to apply robots in both front-of-house and back-of-house retail activities include:

- goods management (e.g., inventory robots, stock control robots, surveillance)

- front office and customer experience (e.g., customer greeting and entertainment, product information and demonstration, promotion, augmented virtual reality)

- customer services merchandise (e.g., product picking, automatic payment, virtual queue, product delivery)

- customer path analysis (e.g., customer count, trajectory analysis, behaviour and emotion analysis) [ROL16].

Most robots in customer-facing roles in retail are stationary, which reduces their effectiveness. Technologies are required that allow these robots to cope with stairs, doorways, kerbs and similar, as well as potentially unsealed floors/roads in rural retail applications.

IT and communications

IT and communications are the foundation industries for Australia to successfully deploy robotic technologies, therefore Australia needs a strong technology sector. In general, Australia needs better communications networks to deliver remote services. While networks currently have an IoT focus, robots are the ultimate IoT device. More focus in the future will be on connecting individuals within the Australian population rather than providing services based on geography. The geographic approach leaves large portions of primary production land, and interconnecting highways, without adequate coverage for autonomous vehicles, or other communication for robotics.