Robotics and the space industry today

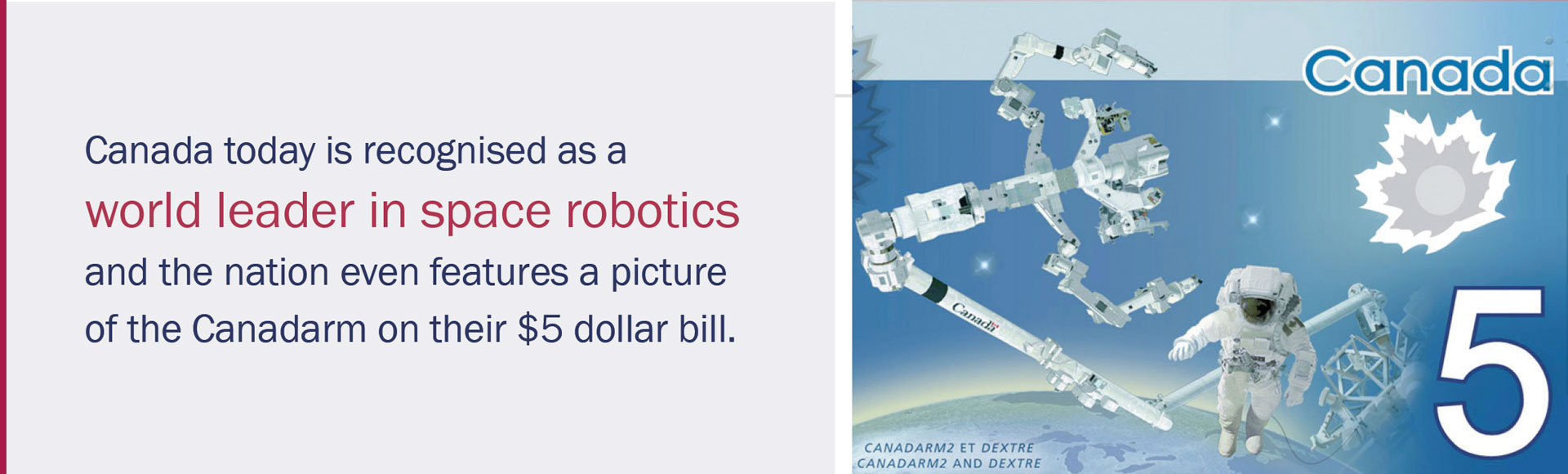

Countries invest in space capabilities to fulfil national objectives including military success and defence strategies, leadership and prestige, development and resource management, and economic growth and diversification [GSS17]. Canada provides an example of a country that has benefitted from investment in the space industry. The Canadian government directly funded Canadarm, the robotic arm that was used to manoeuvre hardware in and out of the cargo bay of NASA’s space shuttle. Canadarm was developed in the late 1970s by a Canadian industrial consortium and its success led to Canada’s role in the International Space Station (ISS) as supplier of the robotic mobile servicing system. This system played a key role in ISS assembly and is now used to move equipment and supplies around the facility. Canada is now recognised as a world leader in space robotics and the nation even features a picture of the Canadarm on the Canadian $5 dollar bill.

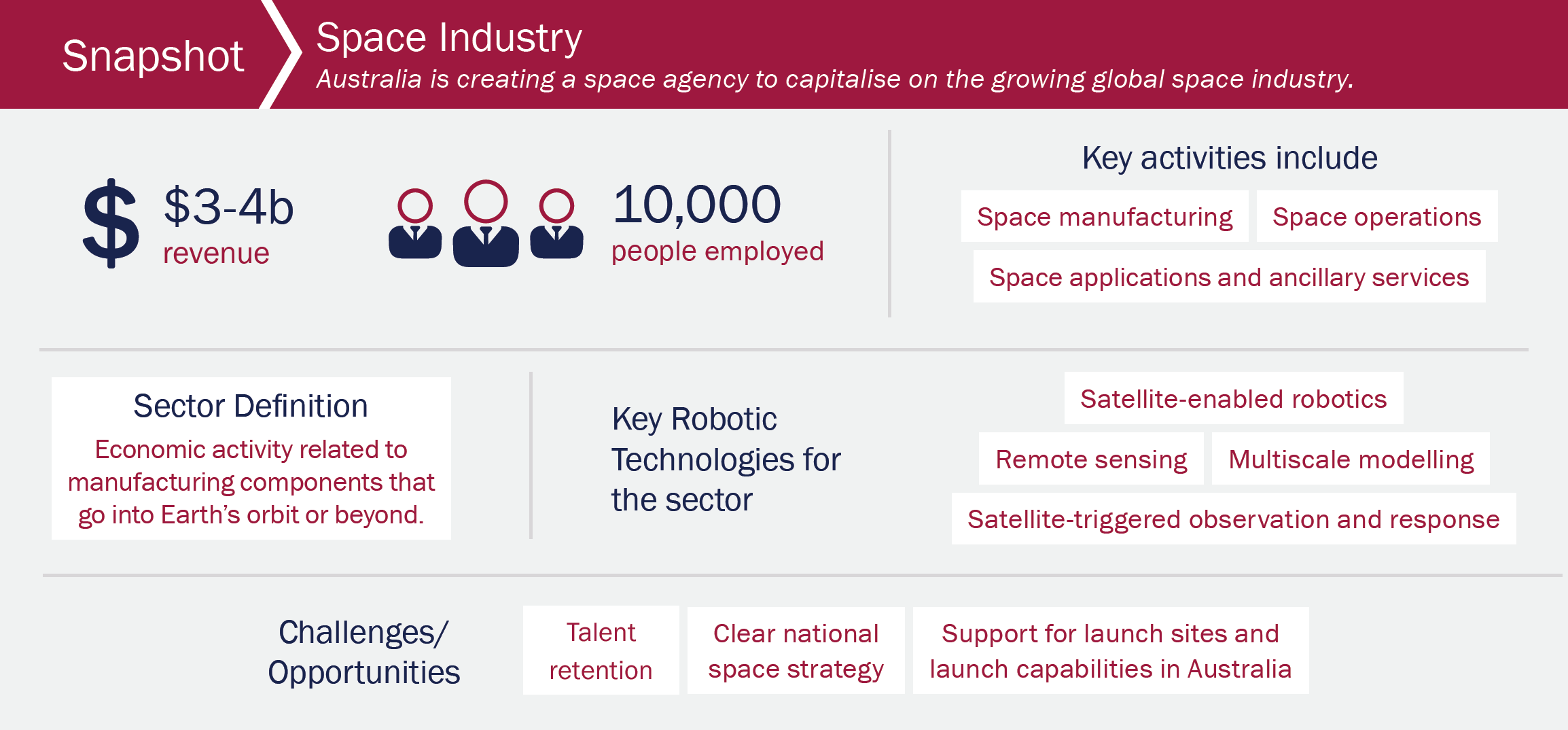

Australia is the largest consumer of data from earth observation satellites (EOS) so developing additional capacity or EOS can provide Australia with a competitive advantage. The creation of Australia’s space agency will encourage further development and use of CubeSats (tiny satellites for space research that weigh less than 2 kilograms) for collecting data. The market for small satellites like CubeSats is expected to be $AU23 billion over the next decade. CubeSats can use vision-based navigation for autonomous cooperative docking [AA18], for example on the International Space Station (ISS), although this has not been tested in practice [PI18].

Australia currently collects data from more than 20 satellites and relies on a strategic partnership with NASA to launch satellites and gain access to NASA’s deep space network. Australia hosts one of NASA’s network satellite bases, ground facilities for the US wideband global SATCOM (WGS) system, and mobile user objective system (MUOS) programs. Australia’s close strategic alliance with the United States (US) means it is also a key partner in several US-led military space activities, including satellite programs and space situational awareness (SSA), with radar and optical space surveillance systems located here.

The competitive attributes that Australia has which make it successful in the space industry include high levels of education, proximity to other nations with space budgets and business-friendly policies, an advantageous geographic location in the southern hemisphere for satellite ground stations, world-class capabilities in ground systems, software, and applications, and close strategic alliances with space powers including the US [ACIL17]. Several global space companies, including US aerospace and defence giants Boeing, Lockheed Martin, and Northrop Grumman, maintain a significant presence in Australia. High-tech jobs associated with these companies, and servicing Australia’s own space infrastructure, ensure Australia has the capabilities necessary to take advantage of future commercial opportunities in the space industry. The Australian Government plans to increase defence spending to 2 per cent of GDP by 2020-21, representing a further growth opportunity with access to high-resolution commercial satellite imagery – a key driver for the ADF (see Chapter 8).

A series of articles about Canada’s golden age of robotics by Tom Green describes Canada’s emergence as a robotics powerhouse [ARR17]. In much the same way as Canada has built on its initial 1975 Canadarms, by developing a series of robot arms (Canadarms 1, 2, and 3) for NASA Space Shuttle orbiters and the ISS, the Australian space industry could be a catalyst for the development of an Australian robotics industry. While Australia has many similarities to Canada, including low population density, a culture of ingenuity, and an economy with strong contributions from primary industries, it has been lacking an overarching challenge for discrete robotics groups to tackle as a national initiative. Australia’s new space agency could spark a similar golden age for Australian robotics, focussed on building upon proven remote sensing capabilities. Consequently, we are keen to see

robotics recognised as an essential technology platform by Australia’s new space agency.

Australia has strong capabilities in integrating data received from satellite and space-based infrastructure into ground-based applications to enable automation driven by demand from the Department of Defence, disaster management agencies, agriculture, built environment, and finance and insurance [ACIL15]. Other areas where Australia could apply robotics technologies within the space industry include the manufacture of nano- and micro-satellites, giving both satellites autonomous and vision capabilities, the autonomous handling associated with launch missions, and space applications linking EOFS with robot operations in sectors such as agriculture (this Chapter), resources (see Chapter 4), logistics (see Chapter 7), aviation and defence (see Chapter 8). Such applications could also build on Australia’s strength in position, navigation and timing (PNT), and in sensor fusion (the integration of multiple signals), essential attributes for controlling autonomous systems. There is also an emerging capability in manoeuvring and managing space debris through the work of the Space Environment Research Centre at Mount Stromlo where robotics could be applied.